Multi-currency, multi-country, multi-accounting. With flexible rules, planning, chart of accounts, summary roll-ups and unlimited parallel budgets and forecasts your finance departments is able to perform at peak performance.

PROFIT FROM YOUR NEW FINANCES ENVIRONMENT: HIGHLY SECURE, ACCURATE, CLEAR AND RELIABLE

- IMPROVE FINANCIAL VISIBILITY

- MINIMIZE HUMAN ERROR

- MAKE BETTER FINANCIAL DECISIONS

- OPTIMIZE THE FINANCIAL PROCESS

ERP FUNCTIONALITIES

Make financial processes easy to handle and completely transparent. Handle all transaction volumes, including a full range of purchasing and payment processes in multiple simultaneous currencies. Use it for multi-layer operations in several countries, or in a wholesale distribution warehouse. Its integrated financial tools help you manage capital costs, assets, cash, and other resources required to run a modern wholesale distribution business including:

- A General Ledger designed for efficient, easy-to-use daily accounting that gives the management team the insight it needs to make better decisions. Now your entire operational performance is clear, transparent and accounted for

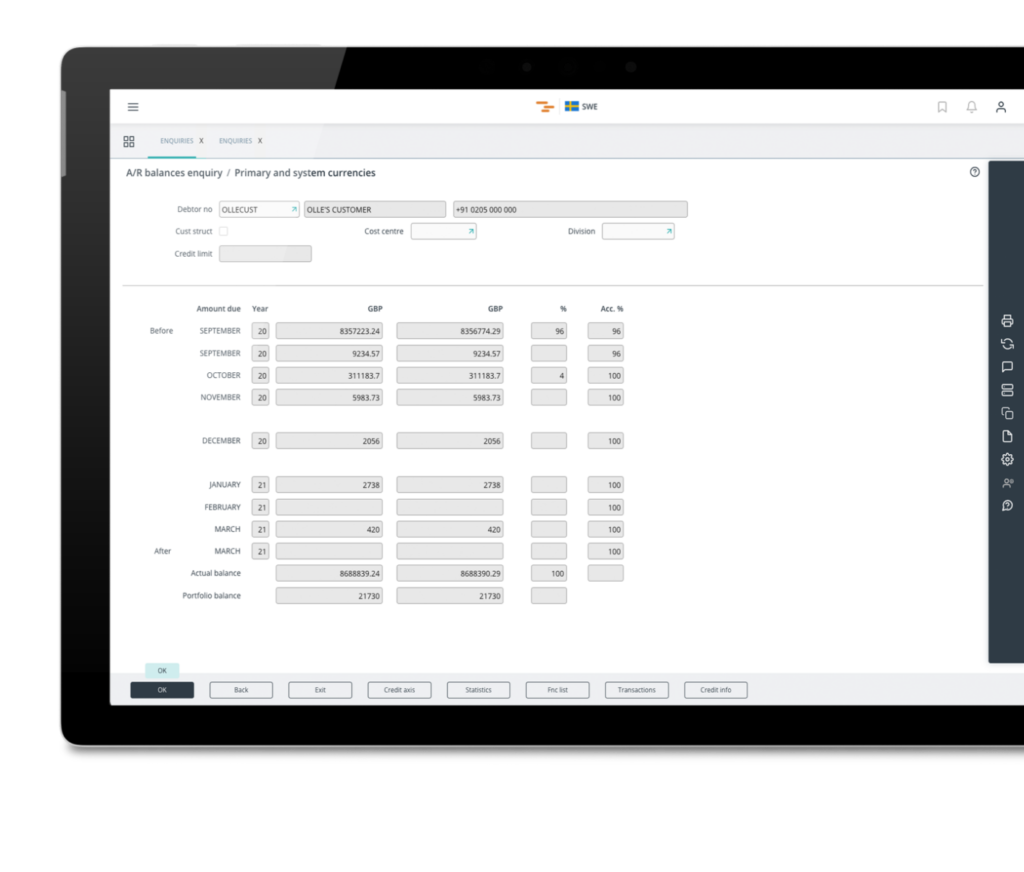

- Accounts Receivable that lets you manage and monitor every receipt process

- Accounts Payable with a sub-ledger that mirrors Accounts Receivable, offering rich, secure functionality handled in a consistent way with core processes

- Sundry Invoicing enabling billing of non-standard business in your sales flow

- Intelligent cash flow management to plan, create forecasts, simulate, and manage your business to gain control over your cash flow

- Multi-currency and tax compliance for comprehensive multi-country tax planning and compliance, and automatic conversion and reporting of multicurrency transactions

Connect the procurement and entire supply chain processes through the goods receipt process to payment to the supplier. Optimize the flow of requisitioning, purchasing and payment.

Benefits:

- Automated processes

- Efficiency, cost savings and control

- Compliance with suppliers, contracts, tax laws, and policies

- Electronic transaction capture

- Reduced errors, fraud and risk

- Financial and procurement transparency

Invest with the confidence that assets are accounted for, insured, serviced, and in the right place. All assets are controlled from a single system that enables the calculation of useful life and depreciation; handle leasing, non-tangible assets and financial assets; automatically calculate profit and loss, and update for reconciliation; make budget comparisons, plan future investments and depreciation, and revalue assets to manage insurance premiums. Physically, the system enables the management of inventory lists by location, asset type or project, identify missing assets, number and label assets, sort insurance information by asset or by insurance tables, maintain warranty information and manage service contracts.

Financially it enables you to:

- Calculate useful life

- Work out depreciation

- Handle leasing, non-tangible assets and financial assets

- Automatically calculate profit and loss, and update easily for reconciliation

- Make budget comparisons

- Plan future investments and depreciation

- Revalue assets to manage insurance premiums

With physical control of your assets, Asset Management enables you to:

- Manage inventory lists by location, asset type or project

- Identify missing assets

- Number and label assets

- Sort insurance information by asset or by insurance tables

- Maintain warranty information

- Manage service contracts

- Trigger decision date prompts for renewal of service contracts

Data is everywhere, but creating it alone is not enough. Analytics makes data from all sources easy to access and analyze, providing meaningful insight to drive innovation and competitive advantage in the digital business world. Automate the capture, combination and analysis of actual and future activity data to proactively monitor operations, be alerted to potential issues, perform “what if” analysis and closed-loop performance management, and iteratively improve business processes with functionality including:

- Performance management – A comprehensive KPI based foundation is combined with a robust, analytic environment to provide a complete platform for building Business Intelligence screens and reports

- Cross functional collaboration – Break down the complex, cross-functional barriers that impede effective business decision making and replace it with a collaborative and interactive environment

- Data consolidation and clarification – A common sense data dictionary layer removes the need for analytics users to know and understand specific database table and field names. By combining and associating data from multiple sources, the solution creates a single stream of insight that is extremely easy to utilize

- Alert Management – Receive automated alerts when business operations are outside pre-set performance parameters in order to take action and rectify potential issues

- Role tailored, graphical interface – Role specific insight dashboards deliver relevant information via an intuitive graphical interface e.g. Sales Executives, Business Managers, Finance and Business Analysts, Casual users, Customer and Partners

- Rapid query performance – In-memory processing, intelligent caching and a broad set of optimizations

Consolidation and group reporting with financial management that includes true multi-currency functionality for any of the world’s currencies, with an option for dual system currency for reporting and other uses. The software is genuinely multilingual for use and the production of documents. Processing and analysis can be done on many levels for an international business, such as company, division, cost center, account group and currency.

Cloud based AP automation that eliminates time-consuming manual work to accelerate your invoice processing. It automates the coding, distribution and approval process for expense invoices based on your operations and the way your business is organized. The advanced matching engine also makes it possible to automatically process over 90% of purchase order-based invoices without any manual intervention.

Your team can easily and quickly approve invoices, whether at their desks or on the go with an intuitive mobile solution. And a shorter approval process ensures that you can pay your suppliers on time, every time. That means no more late fees, stronger relationships with your suppliers, and even the opportunity to capture early payment discounts.

With AP Automation you can:

- Improve your supplier relationships by ensuring vendors are paid on time every time

- Gain access to more accurate financial reporting and forecasting, leading to greater control over hard-to-predict indirect spend